Author: Adrian FitzGerald, ASIP

The restoration of a positive, long-term equity risk premium is looking increasingly likely, argues Adrian FitzGerald, ASIP.

Five years ago I presented an analysis (Re-Thinking the Risk Premium, Professional Investor Summer 2013) of relative performance trends within the UK financial markets. It concluded that, following a period of outperformance by UK gilts over equities, the ex-ante, or forward-looking, equity risk premium, was beginning to look attractive. Consequently, it was argued that investors proposing to reduce their relative exposure to equities further should pause for thought.

Gilts have continued to produce outperformance since that analysis was undertaken as a result of further declines in nominal and real interest rates. However, that decline in both conventional gilt yields and the real rates available on long index-linked gilts, as shown in Figure 1, has pushed the implied, forward-looking risk premium to even higher levels. The purpose of this analysis is to examine these recent relative trends and to highlight again the relative opportunities that appear to be arising.

Figure 1: UK interest rates. Source: Adrian FitzGerald, ASIP.

The background

Life for investment and finance professionals in the 1970s was reasonably uncomplicated. Investors were generally regarded as rational, risk-averse individuals and the efficient market hypothesis was widely accepted.

The ‘cult of the equity’ was also firmly established by that time and survived despite the fact that equity investors had to experience a major bear market during the decade. Moreover, convincing academic evidence emerged from the London Business School (1978) to suggest that UK equity investors should assume a long-term risk premium over risk-free returns of around 9% per annum, albeit that this estimate was subsequently revised down. It is not surprising, therefore, that UK pension fund assets, in particular, were heavily-weighted in favour of equities.

Today’s investment world is very different. It is still widely accepted that developed equity markets are efficient inasmuch as it is extremely difficult for investors to outperform those markets consistently. However, the 2017 award of the Nobel Prize for Economics to Richard Thaler serve to confirm acceptance of the fact that behavioural influences in financial markets can be significant. Investors do not always behave rationally. Indeed, the October 1987 Crash and the dot-com bubble during the late 1990s provided evidence that irrational herding can at times create unjustified valuation bubbles.

The UK equity risk premium – that reward for risk-bearing – has also vanished. Equities have outperformed long gilts by 0.4% per annum over the past half century. However, a closer analysis shows that this outperformance was all achieved during the years prior to the 1987 Crash, as Figure 2 indicates. Equities have, in fact, underperformed long gilts by 1.3% per annum since that date.

Figure 2: Cumulative UK ex-post equity risk premium. Source: Adrian FitzGerald, ASIP.

It is not surprising, therefore, that, against this background, the strategic asset allocation for a typical UK defined benefit pension scheme has undergone a significant transformation. Equity exposure in excess of 70% was not uncommon in the 1970s and 1980s. That exposure has now dipped below 30% (Source: Mercer, European Asset Allocation Survey, 2017).

The ex-ante equity risk premium

Figure 3 shows a 50-year history for the ex-ante equity risk premium (ERP). At any point it is an estimate of the difference between the expected, long-term equity return and long gilt returns based on prevailing economic and market conditions.

Figure 3: UK ex-ante equity risk premium. Source: Adrian FitzGerald, ASIP.

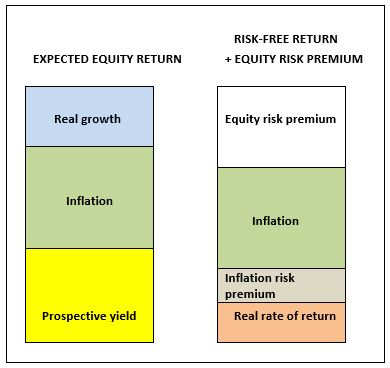

Figure 4: Expected return components. Source: Adrian FitzGerald, ASIP.

The expected inflation element can be stripped out of both equity and bond returns. Consequently, an ex-ante estimate of the equity risk premium is provided by:

Prospective dividend yield

plus

real dividend growth

minus

real rate of return

minus

inflation risk premium

The variables used are:

- The redemption yield on long-dated government gilts (Treasury 31/2% 45 currently used as benchmark

- A constant real dividend growth expectation of 1.5%, the average growth experienced over the fifty-year period, is assumed

- The real rate of return is the yield on long index-linked gilts since 1981 and is simulated prior to that date. (Real rate on Treasury 0.125% 68 currently used as benchmark).

- Expected inflation is assumed to be 80% of the ‘inflation gap’ at any point. The remaining 20%is assumed to represent the inflation risk premium.

- The prospective dividend yield is the published dividend yield on the FTSE All-Share index increased by nominal expected growth (real growth of 1.5% + expected inflation component of the risk-free return).

The highest level reached in the ex-ante risk premium over the past fifty years was 7.1% at the bottom of the 1974 bear market; the lowest level reached was -0.6% in the third quarter of 1987 prior to the equity market collapse in October of that year. The average level of the ex-ante ERP over the whole period was 2.4%.

The price-earnings approach

It is understandable that investors are nervous with regard to equities in the light of the poor performance experienced in 2018 and current political and economic uncertainties. However, the end 2018 level of the ex-ante premium at 7.0% (its highest level since the trough of the 1974 bear market) appears to suggest, that UK equities are now offering attractive relative value. This conclusion is can also be reached by considering current P/E levels.

The price-earnings indicator has to be viewed as a relative valuation measure. Higher levels are justified if, and when, interest rates decline. The full, theoretical expression for the valuation measure, derived by introducing earnings into the Gordon growth relationship highlights this:

Price/Earnings = Payout ratio (expected dividend/earnings)/(discount factor – expected long-term growth)

Where:

- the dividend used is the expected first year dividend

- the discount factor is comprised of the long-term risk free alternative + a required risk premium

- the expected long-term growth rate is comprised of expected inflation and expected real growth. The long-term inflation expectation is derived from the assumed long interest rate and, as before, real growth is assumed to be 1.5% per annum.

Figure 5 indicates equilibrium price-earnings levels under different long gilt yield and required/implied equity risk premium assumptions, given the current notional dividend and earnings levels of the UK equity market. This shows that the current price-earnings level, at 11.7x, is not demanding in the current interest rate environment where long interest rates are less than 2.0%. Indeed, the indication is that a risk premium of the order of 7% is on offer, in line with the results of the ex-ante risk premium analysis described earlier.

Figure 5: Theoretical P/E levels. Source: Adrian FitzGerald, ASIP.

The Future

Two factors need to be stressed:

- the ex-ante equity risk premium presented here is a quantitative assessment of long-term value which utilises long-term assumptions, notably regarding future inflation and real dividend growth. No conclusions can be drawn regarding short and medium-term values.

- the risk premium is, of course, a relative indicator. Equities are bound to suffer along with gilts if, for example, interest rates were to rise significantly.

What is being indicated in the above analysis, however, is that the restoration of a positive, long-term equity risk premium is looking increasingly likely. Furthermore, there is certainly a case for a fresh and close review of asset allocation strategy.

Author: Adrian FitzGerald, ASIP

Author: Adrian FitzGerald, ASIP