- Adhering to CFA Institute’s Code and Standards viewed as increasingly challenging

- ‘Duties to clients’ the one area deemed easier to meet the standards this year

All CFA UK members agree annually to abide by, and adhere to, CFA Institute’s Code of Ethics and Standards of Professional Conduct. This commitment to high ethical and professional standards underpins their membership and the promotion and support for such standards is a key part of CFA UK’s mission. The society’s 2016 annual Ethics Survey indicates that some members are finding it increasingly challenging to adhere to the Code and Standards.

View infograpic in full

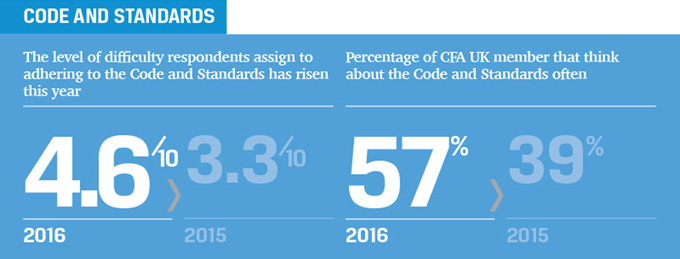

CFA UK’s survey asks members to score the ease or difficulty of adhering to the Code and Standards over the past year on a range from one to 10, where one is easy and 10 is difficult. The 2016 results show a marked increase on the prior year, with a rating of 4.6 compared to a score of 3.3 in 2015 and 3.0 in 2013 when the survey was first undertaken. Whereas last year, just 14% of respondents scored the difficulty of adhering to the code and standards at 7 or above, this year 32% of members give it such a score.

However, while the survey suggests that respondents are finding it more difficult to maintain high ethical and professional standards, it also indicates that CFA UK members are thinking about the code and standards more regularly (with the number of respondents thinking about them often increasing from 39% last year to 57% this year) and remain focused on putting their clients’ interests first. The proportion of those who personally found it difficult to meet the duties to clients has fallen from 37% to 33% this year.

Says Will Goodhart, chief executive of CFA UK:

“Achieving and maintaining high ethical and professional standards in investment management is critical if we are to act in our clients’ best interests. This year’s survey results contain bad news in that our members clearly feel that it is getting harder to do the right thing, but they also carry good news in that members are increasingly aware of the importance of professionalism, are relying on the code and standards more extensively and are finding it easier to meet their duties to clients.”

There has been a particularly sharp increase in the reported level of difficulty experienced in relation to the standards on ‘investment analysis, recommendations and actions,’ which encompass diligence and reasonable basis, communication with clients and prospective clients and record retention. More than a third of respondents (34.7%) highlight it as a challenging element for them over the past year up from 26.4% in 2015.

When asked to highlight challenging areas for the profession as a whole (rather than for them individually), more than half of respondents point to ‘conflicts of interest’ (58.9%). This remains the area which is perceived as most challenging for the profession as a whole. ‘Investment analysis’ is the area where there has been the sharpest increase this year (with 38% of respondents selecting it as a challenging area for the profession as a whole this year, versus 28% last year). ‘Integrity of capital markets’ was the only area to record a fall (down 1% from 47% to 46%) with all other areas (‘professionalism,’ ‘duties to employers,’ and ‘duties to clients’) showing a year on year increase in the number of respondents who consider the areas to be challenging for the profession as a whole

View infographic in full

‘Professionalism’, ‘duties to clients’ and ‘conflicts of interest’, continue to be areas where investors feel that they should have further practical guidance and support from CFA UK and CFA Institute - with more than 50% of respondents stating that this should be given. More than three quarters of survey respondents (78.6%) think that CFA UK and CFA Institute should provide practical guidance and training on ethics to firms.

Existing programmes and support from CFA UK and CFA Institute include a wide range of online learning resources, regular events, specific training on ethical leadership and online guidance on holding the line, speaking up and whistleblowing.

Says Annabel Gillard, CFA, chair of CFA UK’s Ethics Committee:

“We are committed to helping our members meet their professional and ethical obligations. This year’s results underline the importance of support around ethics and professionalism, particularly around managing conflicts of interests and meeting duties to clients, but it is good to see evidence of our members’ awareness of the ethical issues facing them in their professional lives. We look forward to continuing to work with them and their employers over the coming year to help them find ways to meet the challenges that they face. With trust so hard to earn and so easy to lose, it is vitally important that the profession recognises the fundamental importance of behaving ethically and professionally.”

Survey details: The CFA UK Annual Ethics Survey ran between 7 March 2016 and 4 April 2016 and was completed by 558 CFA UK members.