How corporate governance factors can influence financial performance

Author: George Serafeim, Daniel Rourke, Hellen Mbugua, and Christina Rehnberg

New research reveals that corporate governance factors can be positively linked to financial performance.

| Calvert examined how 10 governance factors, ranging from accounting risk to shareholder rights, materially affected financial performance of more than 8,500 companies in 72 countries. It found that the impact the factors had on corporate performance differed depending on the relative strength of governance practices and rules in its country of domicile. The research offers guidance for investors in assessing the impact of governance factors in four country “clusters”: Strong practices/strong rules; strong practices/weak rules; weak practices/strong rules; weak practices/weak rules. |

Corporate governance assessments are an integral part of company research, because they can be an indicator of how well a company identifies material environmental and social factors and manages associated risks and opportunities. Identifying those issues can be the first step in mitigating risk or unlocking long-term value.

However, incorporating governance information into investment decision-making poses challenges. There is an abundance of publicly available data, including measures of board and committee independence, director equity policies, internal pay equity, director elections and shareholder rights to convene meetings. But there is little clarity on which of those measures may be linked to performance, or the impact the rules and practices of different countries may have on those links. The latter is especially relevant as responsible investing becomes an increasingly global phenomenon.

Our previous research suggested that this is a fertile area for study. For example, historically, we have stressed the importance of board diversity when making investment decisions because of the link we found between this factor and corporate performance. This insight suggested that it would be fruitful to look for other differentiating factors in corporate governance.

The research summarized in this paper is designed to improve our understanding of the link between governance factors and performance. We believe it can provide meaningful insights when making investment and engagement decisions.

Framework

Corporate governance is the overarching framework that sets the direction of a business, including its purpose, goals and strategy. A company’s governance structure determines who has the legal power to make decisions within the business and how that power is checked and balanced, including the consideration of stakeholder interests.

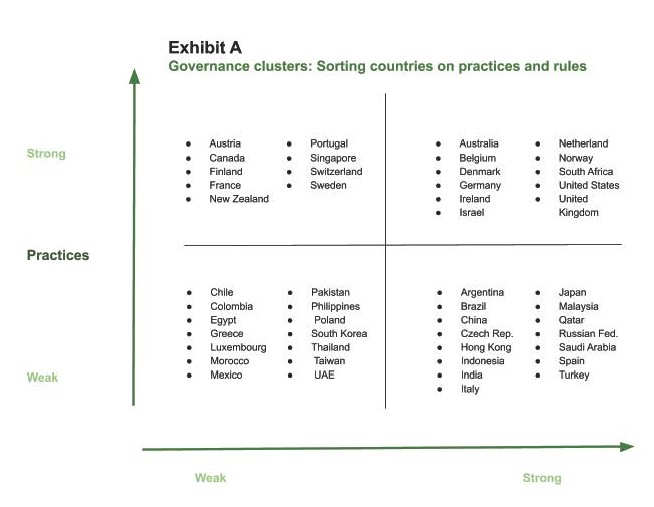

Our research found that certain factors within a company’s governance structure are linked to corporate performance. However, as we discuss more fully below, the strength of the links varied, depending on both corporate practices and country-level rules within a given country. Our analysis showed that the state of corporate governance in the universe of 72 countries examined could best be categorized in four clusters:

- Strong corporate practices/strong country rules

- Strong corporate practices/weak country rules

- Weak corporate practices/strong country rules

- Weak corporate practices/weak country rules

Methodology

To assign a country to its proper cluster among the four described above, we evaluated its strength along two proprietary indexes for measuring governance:

- A practices index designed to classify overall governance practices as “strong” or “weak” based on a bottom-up survey of companies with each country. We examined more than 8,500 companies within 72 countries in the MSCI database, across a range of about 100 metrics applicable to 10 broad governance factors (e.g., board effectiveness, accounting risk, pay figures, etc.). Every company received a grade on each factor and we assessed those factor grades at the country-level to assign “strong” or “weak” designations for practices.

- A rules index designed to classify a country’s overall governance rules as “strong” or “weak,” based on a top-down survey of its laws, exchange listing requirements and corporate governance codes. We examined 58 countries and used OECD data across a range of about 70 metrics (e.g., board effectiveness, audit oversight, pay figures, etc.). Each governance rules metric received a grade, and we used the aggregate of those scores to assign each country a “strong” or “weak” designation for rules.

Sources: Calvert Research and Management, OECD Factbook 2017, MSCI, as of September 2019.

A universe of 72 countries in the MSCI database was narrowed to 58 that have OECD Factbook or equivalent data; this was reduced to 49 by including only countries with five or more companies.

Next, we looked at 10 governance factors to determine their relationship between financial performance of all of the companies in the 49 countries. The factors were:

| 1. Accounting Risk | 6. Pay Figures |

| 2. Audit Oversight | 7. Pay oversight |

| 3. Board Effectiveness | 8. Pay Performance Alignment |

| 4. Board Independence | 9. Ownership Structure |

| 5. Director Elections | 10. Shareholder Rights |

For each company in the 49-country universe, we regressed these factors on return on assets (ROA), return on invested capital (ROIC), natural log of price-to-equity ratio (P/E) and the natural log of price-to-book ratio (P/B), controlling for country, market capitalization and industry classification.

By aligning the results of these regression analyses within their countries, in their respective clusters, we could identify which governance factors had the most impact on performance of companies with each quadrant. For example, if a factor like board effectiveness showed a significant positive relationship with performance in countries with strong practices and strong rules, would that also be the case in countries with weak practices and weak rules? Or which, if any, of the factors were material across the most clusters?

Research findings

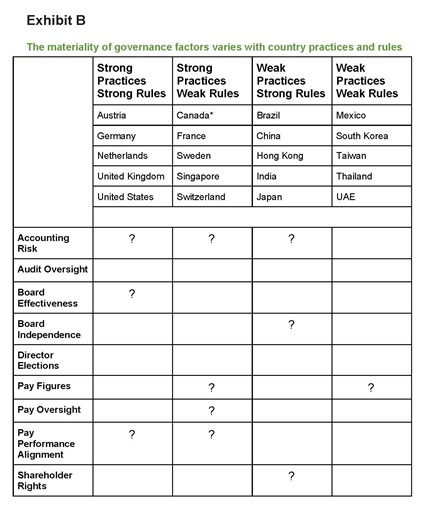

Exhibit B provides an overview of the material issues we found within each of the four clusters, along with the five largest countries in each cluster, by total market capitalization of listed equities. Within each cluster, we found two to five governance factors to be financially material, with accounting risk and ownership structure most broadly represented across countries.

Source: Calvert Research and Management, August 2020.

The above classifications are for illustrative purposes and represent the five largest countries by market capitalization in each classification; in total, we classified 49 countries for this research.

*To correct for an observed North American bias in disclosure data, companies in the US and Canada are separated from their clusters to calculate scores. Our materiality assessment remains the same.

Broadly material factors

Accounting risk and ownership structure are gateway factors in most countries.

Accounting risk and ownership structure were both found to be material in three of four of our country clusters. As such, we consider these “gateway factors” for investors in almost any country, with a few notable exceptions discussed below.

In some ways, the finding that accounting risk and ownership structure are broadly material is intuitive. Weak performance on either measure would be a flag for most investors. For example, our measure of accounting risk identifies companies for anomalies in financial reporting, e.g., revenues, expenses and asset-liability valuations. These anomalies can signal problems with how a business is run or indicate if there are potential problems with internal controls. Similarly, weak performance on the ownership structure composite can be an indication of imbalances between share ownership and decision-making power. These imbalances may pose a risk for minority shareholders, who often have limited control or recourse.

Basic governance factors

Board independence, pay figures and shareholder rights are basic measures of governance performance that emerge as material factors in both “weak practices” clusters. For instance, in “weak practices/strong rules” jurisdictions, the governance basics of board independence and shareholder rights are material to corporate performance, in addition to the gateway factors of accounting risk and ownership structure. These are markets where getting the basics right can make a difference in corporate performance.

In “weak practices/weak rules” jurisdictions, the basic issue of pay figures is material to corporate performance, in addition to the gateway factor of ownership structure. In these markets, policymakers have not yet responded to weak practices by strengthening rules. Consequently, without adequate rules, enforcement can become a moot point.

Quality governance factors

Strong practices markets allow for further investor differentiation by quality governance.

In “‘strong practices/strong rules” jurisdictions, the advanced governance quality factors of board effectiveness and pay performance alignment are material, in addition to the gateway factor of accounting risk. These are highly professional markets where board and pay basics are largely ironed out and quality separates the leaders from the laggards.

“Strong practices/weak rules” jurisdictions are highly-professional markets with strong customs, but the absence of adequate enforcement creates challenges in and around executive pay. From a performance perspective, investors should consider how pay decisions are governed, whether a company is transparent about internal pay equity, and whether the CEO pay makes sense for the size and performance of the business.

Conclusion and further research

The country-level cluster classifications outlined in this paper serve as a foundation for further research that investigates the relationship between corporate governance and financial performance. Given the amount of publicly available information on the governance topic, this research guides company-level assessments toward those factors that are financially material depending upon where a company is domiciled. We think these findings can empower the broader investment community to more meaningfully integrate corporate governance assessments into investment and engagement decisions.

Hellen Mbugua is Vice-President, Senior ESG Research Analyst Calvert Research and Management

Hellen Mbugua is Vice-President, Senior ESG Research Analyst Calvert Research and Management

Daniel Rourke is vice president, senior ESG research analyst Calvert Research and Management

Daniel Rourke is vice president, senior ESG research analyst Calvert Research and Management

Christina Rehnberg is a senior associate at KKS Advisors

Christina Rehnberg is a senior associate at KKS Advisors

George Serafeim is the Charles M. Williams Professor of Business Administration at Harvard Business School