Author: Clyde Rossouw

The return of persistent inflation has forced central banks to hike interest rates aggressively, bringing an end to ‘free money’. Some companies are ill-prepared for higher rates and face deep earnings recessions. However, high-quality businesses with robust fundamentals should come into their own, says Clyde Rossouw, Portfolio Manager and Co-Head of Quality Capability at Ninety One.

The end of the false equilibrium

For the past decade and a half, markets have operated within a false equilibrium, where near zero or negative interest rates and quantitative easing distorted the cost of capital, which in turn encouraged excessive risk-taking. When economies and markets tanked during the pandemic, policy makers provided massive stimulus measures to help alleviate tough financial conditions. But persistent inflation has brought an end to this, as central banks across the world have been forced to hike interest rates aggressively to restore price stability. Some businesses are ill-prepared for higher rates, as we saw in the banking sector in the first quarter.

Despite these developments, the Federal Reserve (Fed) is committed to raising rates to lower inflation. It has been able to stick to its guns by making additional funding available to financial institutions to prevent banking liquidity or solvency issues. Rising interest rates have been a major headwind for markets. Investors continue to focus on any possible signs that interest rates may have peaked, and while global inflation has justifiably been a real worry, the health of corporate earnings deserves closer scrutiny.

.

A gloomy economic outlook

Manufacturing activity has been contracting sharply in the US, reflecting the gloomy economic outlook. The bond market is also signalling that it is expecting a significant downturn in economic activity this year, as evidenced by long-term rates being much lower than short-term rates. The difference between 10-year rates and 3-month rates is the steepest it’s been since 1981. Cyclical businesses are feeling the pressure. As companies start losing volumes, their pricing power will suffer, impacting their earnings growth.

For new entrants to the investment profession, he has some advice. “Don’t be afraid to involve yourself in as much as you can across different areas of your business. I also think patience is very important. When we’re young we think we know everything and should be given more experience, but it took at least five years for me to feel confident to be able to provide investors with a clear understanding of the market. Young people can be hasty, looking for career progression every year or two years, but you have to give it time.”

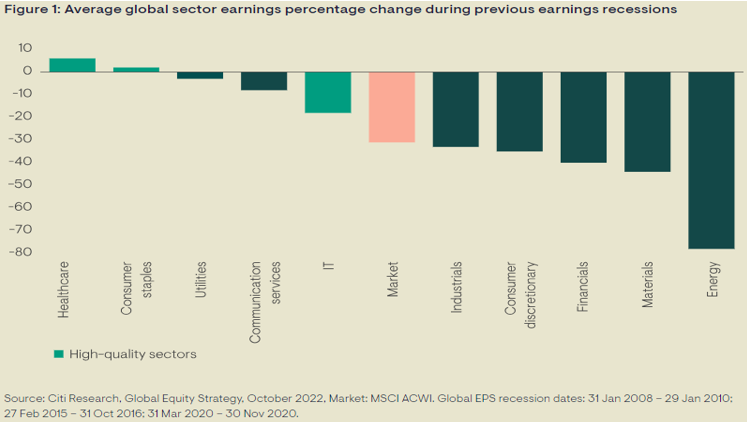

The chart above shows that during challenging economic conditions the energy, materials and financials sectors typically experience a far greater hit to profits compared to other – higher quality – parts of the market. It’s not to say definitively the energy sector will experience such violent moves, but we avoid these types of sectors and focus on areas with greater resilience, such as high-quality healthcare and consumer staples companies.

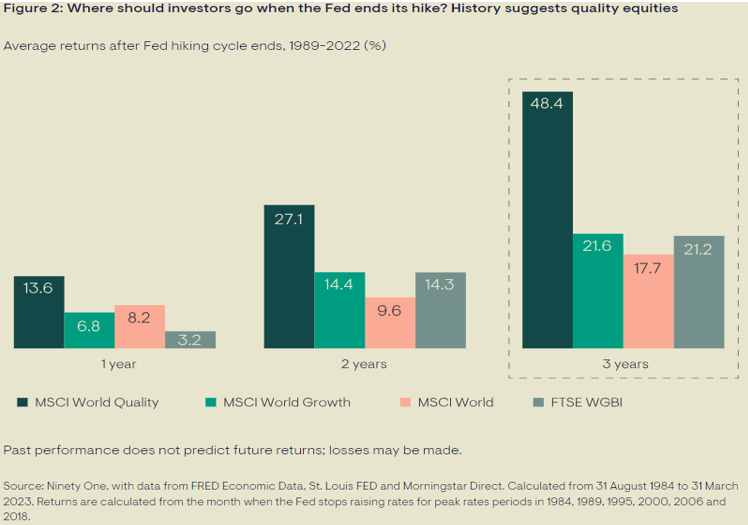

Furthermore, although it is still not clear when the rate cycle will ease, it is notable that quality has historically outperformed as a style in the years after a hiking cycle has ended. As the economic outlook comes under increasing pressure – which may ultimately lead to rates being lowered – quality companies’ earnings and cash flows should prove to be more robust.

Yet it is fair to state that sectors such as staples and healthcare generally have lower levels of growth, so investing in other high-quality opportunities that offer long-term growth is important to balance a portfolio. Semiconductors, for example, have attractive structural growth trends – with some predicting the industry will top US$1 trillion by 2030. But because of inherent cyclical risks, it is important to seek out companies with sound business fundamentals and compelling long-term growth prospects.

Another example of businesses with earnings resilience are the global payments providers, with the two main players having billions of cards in issuance. This provides significant barriers to entry for rival providers, such is the strength of the network effect. Importantly, the companies are protected from inflation because fees are linked to the transaction value. Moreover, they are well positioned as cross border volumes – which are higher margin than domestic payments – continue to recover from their COVID lows.

Coming out of the pandemic, the growth in the leisure sector has been robust, reflecting people’s pent-up demand for holidays. Leaders in online travel are well positioned to capitalise on the recovery in the tourism space, and many have provided upbeat forecasts for the year.

.

Dust off the old playbook

Now that the ‘free-money’ era has ended, it’s time to dust off the old investment playbook and revisit the good, old-fashioned principles of investing. We are going back to a world where fundamentals matter. The problem with businesses that are merely cheap is that their valuation does not protect investors when the fundamentals change for the worse. Cheap shares can be very risky in a difficult market environment.

We expect balance sheets and earnings to take centre stage as we move further through this year. With much uncertainty regarding the future direction of markets, we believe that a focus on quality companies could stand investors in good stead. Their strong pricing power and low debt levels are a powerful buffer against restrictive financial conditions. The overall fundamentals of these high-quality companies remain strong, enhancing their ability to continue to steadily compound cash flows, while weaker rivals come under increasing pressure.

Clyde Rossouw, Portfolio Manager and Co-Head of Quality Capability at Ninety One